georgia property tax exemption nonprofit

Usually there is no GA sales tax exemption to churches religious charitable civic and other nonprofit organizations. The mailing address for Form 3605 is Georgia Department of Revenue 1800 Century Center Blvd.

Election 2020 Results Georgia Statewide Referendum A 11alive Com

Property Tax Rates Explained.

. Local state and federal government websites often end in gov. The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 15 was on the ballot in Georgia on November 4 1980 as a legislatively referred constitutional. If a nonprofit is located in Georgia and is using its property for charitable purposes it may be exempt from paying property taxes.

This search will also. Who is eligible for sales tax exemption in Georgia. No longer required for tax years beginning on or.

To be exempt from Georgia state sales and use tax a nonprofit must fit into a specific exemption category. NE Suite 15311 Atlanta GA 30345-3205. Georgia exempts a property owner from paying property tax on.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Generally Georgia does not grant a sales or use tax exemption to. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of.

The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 17 was on the ballot in Georgia on November 7 1978 as a legislatively referred constitutional. Real property owned by a 501c3 tax-exempt nonprofit organization in Georgia is not automatically exempt from property tax. Of state sales and use tax for nonprofit organizations.

The Georgia Department of Revenue has issued guidance regarding exempt nonprofit organizations. Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity. This article describes some of.

Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. D Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of 1986 and held. Provide a complete downloadable list of organizations that meet any of these criteria.

The property must qualify for one of the listed. The nations average rate is. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate.

To qualify for this exemption the. From 2000 through 2020 20 property tax exemption measures appeared on the statewide ballot of which 17 were approved and three were defeated. Allow you to view an organizations IRS Forms 990 990-EZ andor 990-T for 501.

1 The property is committed to and held in good faith for an exempt use.

Turner County Tax Assessor S Office

Georgia Deed Gift Fill Online Printable Fillable Blank Pdffiller

Introduction To Georgia Property Tax For Nonprofits Youtube

Gsccca Org Pt 61 E Filing Help

Know Your Georgia Property Tax Laws

Which Metro Atlanta Companies Received Tax Breaks In 2016

Sales Tax Keeping The Good Faith In Taking Resale And Exemption Certificates Litwin Law

Jackson County Tax Assessor S Office

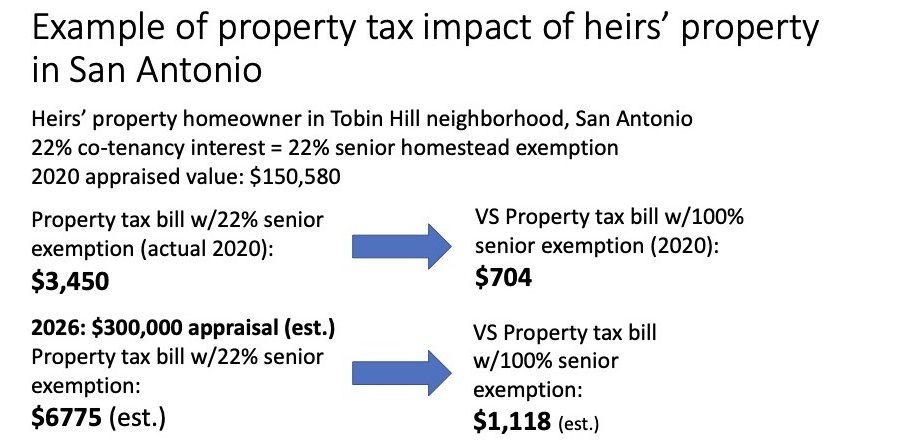

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Dispute Over Tax Exempt Status Of Solarium Leads To Notice Of Tax Sale Decaturish Locally Sourced News

City Of Roswell Property Taxes Roswell Ga

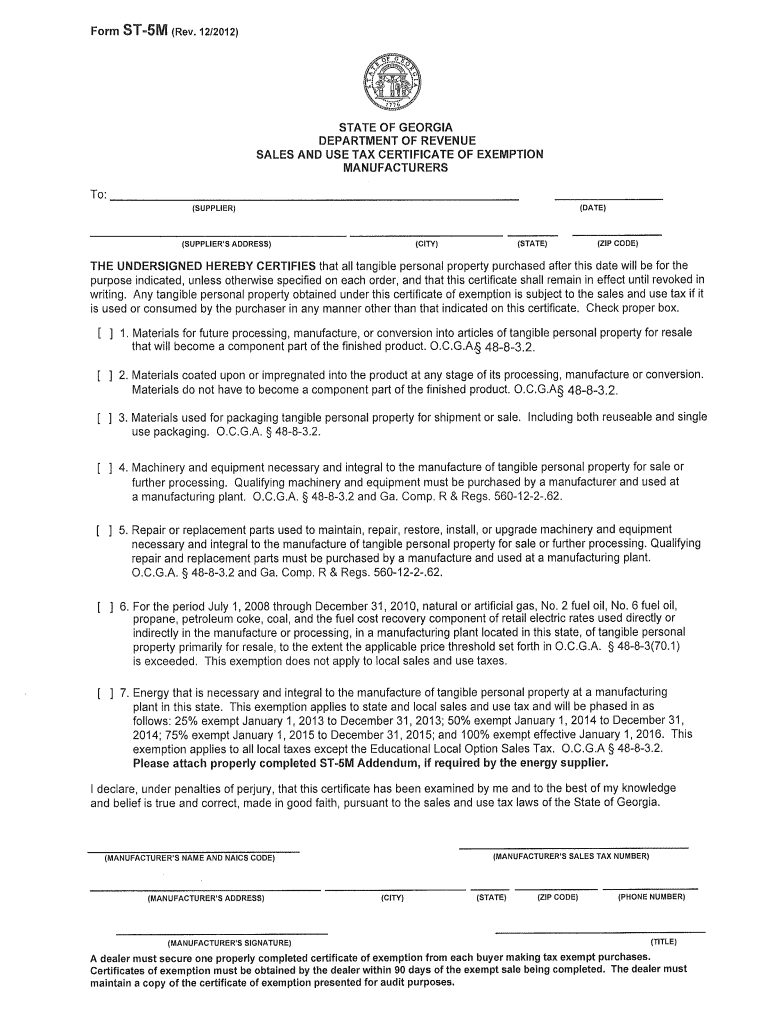

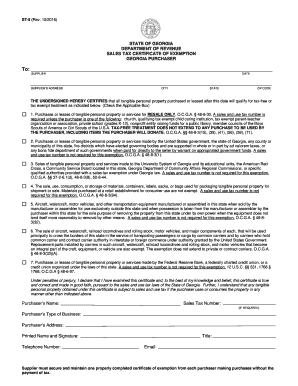

Ga Form St 5m Rev 5 2012 Fill Out Sign Online Dochub

Georgia Charitable Registration Harbor Compliance

Georgia Changes State Tax Lien Law

Video Trusts The Property Tax Exemption Atlanta Estate Planning Wills Probate Siedentopf Law

Historical Georgia Tax Policy Information Ballotpedia

State Property Taxes Reliance On Property Taxes By State

Georgia Exemption Fill Out And Sign Printable Pdf Template Signnow